TEMPO.CO, Jakarta - The surge in crude oil prices due to the Iran-Israel conflict has raised concerns about the increasing burden of Indonesia's energy subsidies. The oil price, which has already breached US$78.50 per barrel and could potentially surpass US$100, is feared to exert significant pressure on the State Budget (APBN) in 2025.

The Indonesian government still sets subsidized fuel prices, such as Pertalite and Solar, far below the economic price. The global price hike widens this gap, which is automatically covered by subsidies from the APBN.

Fahmy Radhi, an Energy Economist at Gadjah Mada University, explained that a US$1 increase per barrel of crude oil could add a subsidy burden of up to Rp2 trillion per year, depending on consumption and the exchange rate of the rupiah. "If the world oil price exceeds US$100 per barrel, the additional subsidy burden could reach tens of trillions of rupiah," he said in a written statement on Monday, June 23, 2025.

In the 2025 State Budget Draft (RAPBN), the government allocated energy subsidies amounting to Rp203.4 trillion, up 1.9 percent from the previous year's realization of Rp177.6 trillion.

Fahmy warned that if the oil price exceeds the projected amount, the government must adjust the APBN (state budget) by either increasing subsidies or cutting other expenditures. "The expenditure on fuel imports also increases, which can drain foreign exchange reserves and weaken the rupiah," he said.

Former Minister of Energy and Mineral Resources, Arcandra Tahar, issued a similar warning on his Instagram account, @arcandra.tahar, on Sunday, June 22, 2025. He assessed that the widening conflict is highly susceptible to disrupting global energy supply and prices. "Iran has the 8th largest oil reserves and the 4th largest gas reserves in the world," he said, as quoted by Tempo.

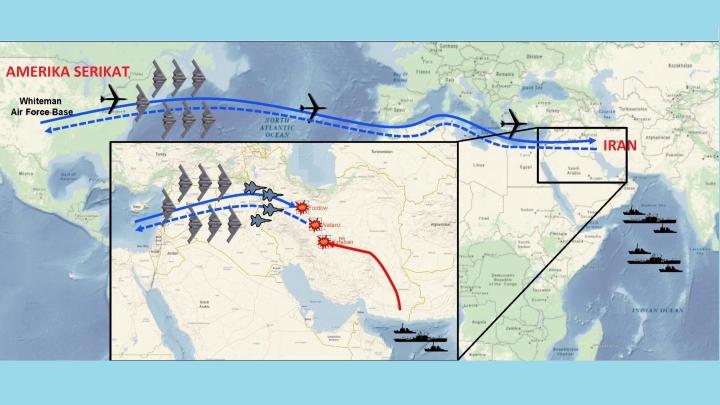

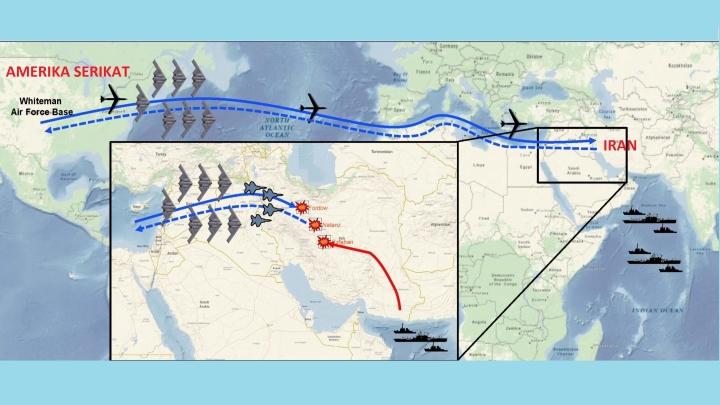

Arcandra estimated that disruptions to Iran's oil and gas facilities could affect about 3 percent of the world's oil supply. He also highlighted the risk of the closure of the Strait of Hormuz, a crucial route for 20 percent of the world's oil and LNG exports. "If the Strait of Hormuz is closed, the oil price could exceed US$ 90 per barrel," he said.

Head of the Communication and Information Service Bureau of the Ministry of Finance, Deni Surjantoro, stated that the government has prepared several mitigation measures. He said that the Iran-Israel conflict could trigger an upsurge in energy prices, global financial turmoil, and supply chain disruptions. Its impact on Indonesia will heavily depend on the scale and duration of the conflict. "If the conflict persists, the pressure on inflation, energy subsidies, and fiscal deficits will increase," Deni said when contacted on Thursday, June 19, 2025.

Deni explained that the first mitigation involves fiscal and monetary coordination between the Ministry of Finance and Bank Indonesia to maintain macroeconomic stability and the exchange rate. The government is strengthening coordination with the OJK and LPS through the Financial System Stability Committee (KSSK) and increasing foreign exchange reserves.

The next steps include targeted fiscal stimulus and adjustments to state expenditure to maintain purchasing power and support the productive sector. The government also promotes energy diversification and strengthens food security. "The government remains optimistic, learning from experiences handling pandemics and global trade tensions," he said.

Finance Minister Sri Mulyani Indrawati emphasized the significant impact of the conflict on the global economy in a monthly APBN press conference last Tuesday. She mentioned that although the oil price is below the 2025 APBN assumption of US$82 per barrel, it is still volatile. On the other hand, the realization of oil and gas lifting has not yet reached the target. "These three variables are influenced by domestic conditions and geopolitical situations, including the Israel-Iran war," said Sri Mulyani.

Ilona Estherina contributed to this article

Editor's Choice: 4 Key Iranian Energy Infrastructures Hit by Israeli Attacks

Click here to get the latest news updates from Tempo on Google News

IHSG Falls 1.7% as Iran-Israel Tensions Escalate

18 menit lalu

IHSG drops by 1.7 percent. Oil and gas stocks rose while the technology sector fell the most amid Iran-Israel tensions.

What's at Risk If Iran Blocks the Strait of Hormuz?

31 menit lalu

The closure of the Strait of Hormuz is one of four potential responses by Iran to the escalating conflict.

Indonesia Pushes OIC to Take Decisive Stand on Middle East Tensions

44 menit lalu

Indonesian Foreign Minister Sugiono urges the OIC to take a stronger stance to resolve the Middle East conflict, especially the Iran-Israel war.

The Complete List of U.S. Military Bases in the Middle East

58 menit lalu

The United States maintains several military bases in the Middle East to protect its economic, energy, and strategic interests.

Strait of Hormuz: 5 Essential Things to Know

1 jam lalu

The Strait of Hormuz is a major shipping route for about 20 to 30 percent of the world's oil supply.

US Strike on Iran Triggers Swift Reactions Across Asia-Pacific

1 jam lalu

Asian-Pacific countries respond to the U.S. attack on Iran's nuclear facilities.

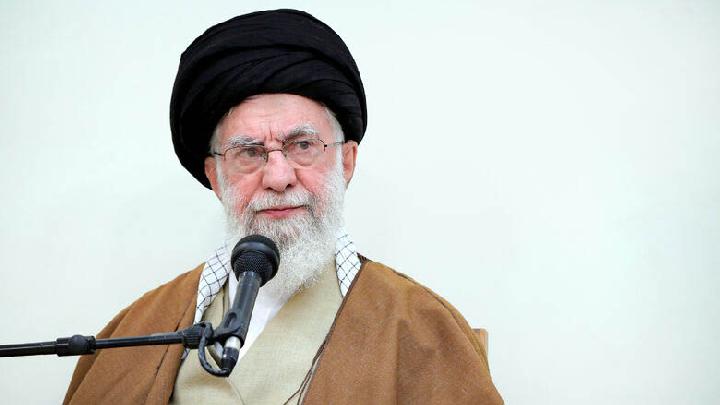

If Khamenei Falls, Who Could Be Iran's Next Supreme Leader?

1 jam lalu

Iran's Supreme Leader Khamenei has reportedly taken emergency steps to secure the leadership and protect himself from assassination.

US Urges China to Prevent Iran from Shutting Strait of Hormuz

2 jam lalu

The U.S. Secretary of State, Marco Rubio, has urged China to persuade Iran not to close the Strait of Hormuz.

Arcandra Tahar: Israel-Iran War Triggers Global Oil Price Surge

4 jam lalu

Former Minister of Energy and Mineral Resources Arcandra Tahar stated that the Israel-Iran war has a significant impact on global oil prices.

Gold Prices May Face Further Correction Amid Iran-Israel Tensions

4 jam lalu

Lukman Leong, a currency analyst at Doo Financial Futures, projects that the world gold price has the potential to correct due to Iran-Israel tensions

:strip_icc():format(jpeg)/kly-media-production/medias/3977835/original/066021800_1648524608-pexels-ahmed-aqtai-2233416_1_.jpg)

:strip_icc():format(jpeg)/kly-media-production/medias/4779768/original/056174500_1711004488-hands-holding-knife-fork-alarm-clock-plate-blue-background.jpg)

:strip_icc():format(jpeg)/kly-media-production/medias/3508689/original/070798000_1626139545-20210713-Elon-Musk-SolarCity-5.jpg)

:strip_icc():format(jpeg)/kly-media-production/medias/1619105/original/061499300_1496997418-ramadan-main.jpg)

:strip_icc():format(jpeg)/kly-media-production/medias/3626995/original/056226000_1636431538-252444828_305857281141144_6357930935168472204_n.jpg)

:strip_icc():format(jpeg)/kly-media-production/medias/4769102/original/014075000_1710171937-20240311-Taraweh_Pertama_di_Istiqlal-ANG_1.jpg)

:strip_icc():format(jpeg)/kly-media-production/medias/4878826/original/064720000_1719661833-WhatsApp_Image_2024-06-28_at_23.09.07.jpeg)

:strip_icc():format(jpeg)/kly-media-production/medias/2265569/original/050855900_1530514161-20180702-Harga-Pertamax-Naik-di-Semua-Daerah--TALLO-4.jpg)

:strip_icc():format(jpeg)/kly-media-production/medias/5141412/original/005545700_1740364919-Snapinsta.app_481203089_18446336839077229_3957692586101845976_n_1080.jpg)

:strip_icc():format(jpeg)/kly-media-production/medias/771429/original/006248600_1416892825-m2.jpg)

:strip_icc():format(jpeg)/kly-media-production/medias/4787912/original/016408900_1711630423-20240328-Penukaran_Uang-AFP_6.jpg)

:strip_icc():format(jpeg)/kly-media-production/medias/5139103/original/083951400_1740056485-Screenshot_20250220_192744_Instagram.jpg)

:strip_icc():format(jpeg)/kly-media-production/medias/2798777/original/080283400_1557223107-20190508-Tadarus-Masjid-Istiqlal-8.jpg)

:strip_icc():format(jpeg)/kly-media-production/medias/4669396/original/057272700_1701340063-male-traveler-montenegro-outdoors.jpg)

:strip_icc():format(jpeg)/kly-media-production/medias/5136140/original/008553400_1739846596-20250218-Tradisi_Nyadran-AFP_5.jpg)

:strip_icc():format(jpeg)/kly-media-production/medias/4683631/original/073976400_1702380433-ilustrasi_melihat_nabi_dalam_mimpi.jpg)

:strip_icc():format(jpeg)/kly-media-production/medias/3022229/original/080968000_1579064783-HL.jpg)

:strip_icc():format(jpeg)/kly-media-production/medias/1637589/original/042512800_1498996834-20170702-Senja-FF2.jpg)

:strip_icc():format(jpeg)/kly-media-production/medias/3055316/original/077027300_1582165451-BN-bsb-jame-asr-hassanil-m-2.jpg)